- Poor Jack's Almanack

- Posts

- Anti-Capitalist Capitalists

Anti-Capitalist Capitalists

The Best Entrepreneurs Aren't Driven By Money

Last week I wrote a tweet that received a decent amount of attention for my standards:

I love the idea from David Senra of anti-capitalist entrepreneurs.

These are entrepreneurs who are driven by a mission rather than maximizing profit numbers.

Because profits are a residual result of quality products and services that are best produced by mission driven people.

— Poor Jack's Almanack (@poorjacks_)

4:00 PM • May 16, 2025

One of my favorite accounts, Boring_Business, tweeted back:

I get where he comes from but really dislike the term. Capitalism at its core is about constant progress to provide quality products that can outcompete other alternatives. To focus on quality is inherently capitalist, not anti-capitalist

— Boring_Business (@BoringBiz_)

4:08 PM • May 16, 2025

And he is totally right.

I think where the semi-disagreement arose is around the idea of a capitalist vs. capitalism.

Whenever I think of a capitalist, I think of someone who is, at their core, driven by money. They seek to grow the bottom-line over everything else and each additional dollar in their pocket gives them a marginal dose of satisfaction. In the words of David Senra this is someone who wants to “take a pile of money and make it into a bigger pile of money.” That is their main motivation.

On the other hand, capitalism is a system that blindly rewards economic participants who can fulfill customer needs and desires in a way that most attractively blends efficiency, quality, perception, and price. Capitalism doesn’t care about the motivations of the participants in its system. It simply allocates rewards to whoever produces the most attractive product or service in the marketplace.

Capitalism has done more to improve the material well-being of mankind than any other phenomenon in human history. It has incentivized into existence such modern miracles as air travel, iPhones, electric vehicles, and eCommerce. And while I love capitalism as a system, I have less respect for the purely money motivated capitalist - the ones who seek to simply make a pile of money bigger without seeking to add additional value to the world.

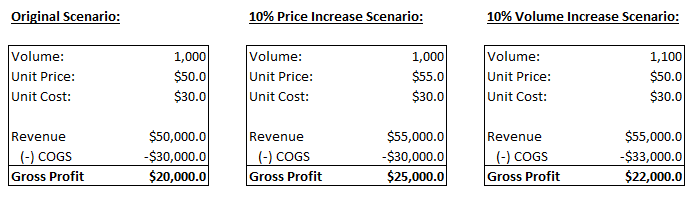

There is a classic question in private equity interviews that asks whether it is better to raise prices by 10% or to sell 10% more product.

The “correct” answer is that, generally, it is better to raise prices because that incremental income flows straight down to the bottom-line. In other words, there is no additional cost for producing your current volume of product but you are receiving 10% more revenue, and therefore generating pure incremental profit when you raise the price.

As you can see in the above example, when you increase the price by 10% you end up with $5,000 in incremental profit whereas when you increase volume sold by 10% you only end up with with $2,000 in incremental profit.

To me, this question epitomizes the idea of a capitalist who is solely interested in making the pile of money bigger. The question is not about improving the product or making the customer experience better, it’s about growing the bottom-line while keeping the experience the same. It’s about extracting as much as possible out of the customer without offering anything additional in return.

But the irony of the capitalist who solely cares about growing the bottom-line is that they rarely build enduring businesses. The people who build the businesses that shape our society and culture, lasting decades of brutal competition in the market, are often built by those who care about money as a secondary motivation and care about the quality of product and service first.

Think about every legendary company developed over the last 100 years.

Apple is a living embodiment of Steve Jobs and his obsession with product design and function.

Amazon is a living embodiment of Jeff Bezos and his obsession with the customer.

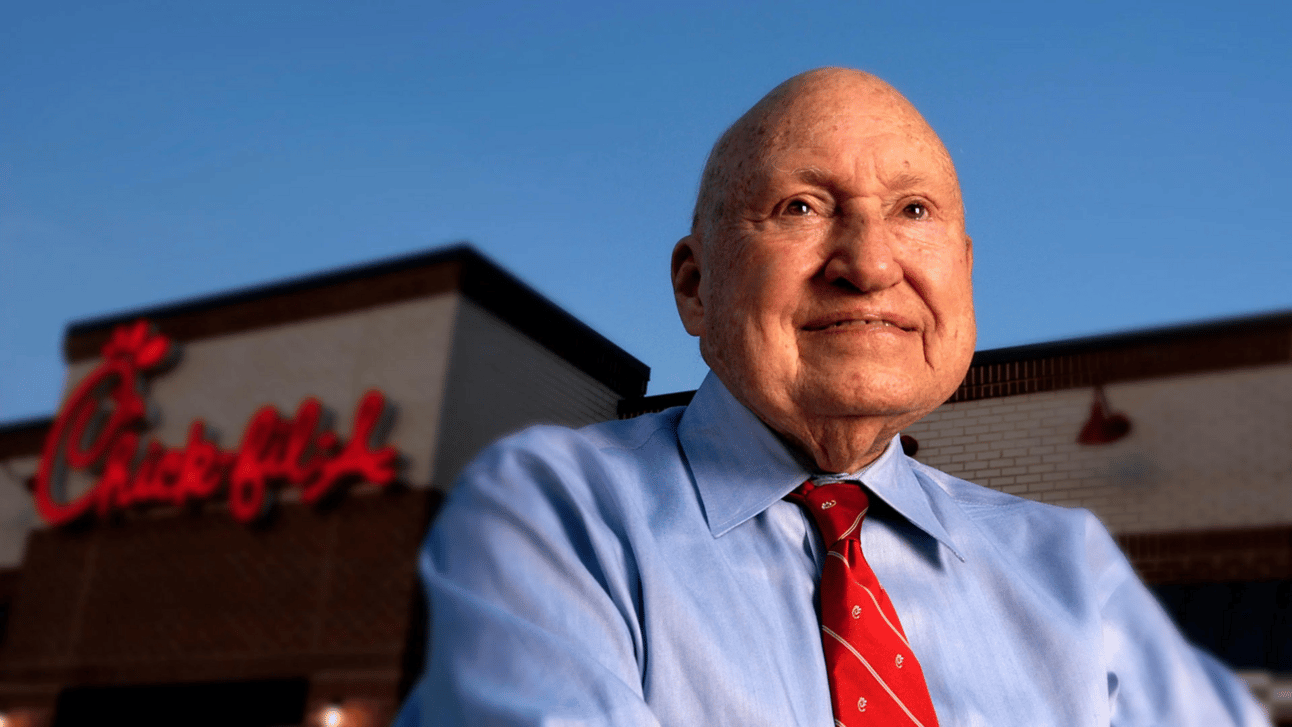

Chick-Fil-A is a living embodiment of Truett Cathy and his obsession with customer service.

None of these founders were obsessed or focused on money. In fact, all of these founders made decisions that were detrimental to the bottom-line in the short-term.

Truett Cathy - the founder of Chick-Fil-A.

Steve Jobs famously insisted upon making the inside of his Macintosh computer just as aesthetically pleasing as the outside despite the fact that the customer would never see it, it caused additional expenses, and was a headache for Apple engineers to implement.

Jobs said of his philosophy - “I want it to be as beautiful as possible, even if it’s inside the box. A great carpenter isn’t going to use lousy wood for the back of a cabinet, even though nobody is going to see it.” The money motivated capitalist likely would have skimped on the interior of the Mac. But Job’s devotion to product design has built a cult like following of customers and become a core part of the Apple culture that permeates the $3 trillion behemoth.

Amazon was famously unprofitable for nearly a decade from its founding in 1994 to 2003. Despite the losses generated by his business, Jeff Bezos never ceased to obsess over getting his customers the lowest possible prices. He knew that over the long run customers would always want low prices, fast delivery, and a large selection so as long as Amazon could provide these things consistently, profits would one day follow.

Receiving approval to become a franchisee at Chick-Fil-A is arguably more difficult than getting into Harvard. This is in contrast to 99% of franchise businesses that are seeking to enroll as many franchisees as possible to increase their royalty stream.

Chick-Fil-A sets a high bar for their franchisees because they want to maintain a high quality customer experience. And this plays out in real life. The experience of going to a Chick-Fil-A in Texas vs New York is remarkably consistent and the infectiously kind and generous attitudes of their workers is present at every single location.

The Cathy family recognized that while growing the number of franchisee partners may be the best thing for profits in the short run, if they wanted to maintain their standards they had to be highly selective about who they let into their system. Today, Chick-Fil-A boasts some of the most attractive unit economics in the industry because of their obsession with only partnering with the most able and high quality operators in the country.

These men built businesses worth a combined trillions of dollars. Yet none of their philosophies centered on money.

Jobs wanted to make amazing products like the iPod, iPhone, and Mac. Bezos wanted to build the Everything Store, an online marketplace where people could conceivably buy anything they wanted at affordable prices. Truett Cathy wanted to build a fast food restaurant that was synonymous with tasty food, affordable prices, and excellent customer service. Those were the top priorities for those three men, not making money.

Jobs, Bezos, and Cathy embodied in entrepreneurship the philosophy that Bill Walsh pioneered in sports which states that “the score takes care of itself” when you “concentrate on what will produce results rather than on the results, the process rather than the prize.”

“Concentrate on what will produce results rather than on the results, the process rather than the prize.” - Bill Walsh

They understood that dollars follow value and value is derived from high quality products and services, delivered efficiently, at attractive price points.

Ironically, these men made massive fortunes not in spite of the fact that their focus was diverted from profits but because their focus was on the goods and services they provided.

Kevin Kelly has a great line that says “The reward for good work is more work.”

“The reward for good work is more work.” - Kevin Kelly

Steve Jobs, Jeff Bezos, and Truett Cathy all loved what they did. They weren’t building a business to get rich, sell their business, or get on the cover of Forbes 30 Under 30. The goal wasn’t to stop. And it’s because of that intrinsic motivation that they were able to build enduring businesses.

The entrepreneur who is looking to continue doing what he does because he loves it is going to beat the entrepreneur who is building a business just to exit it for a large sum of money everyday of the week. And that’s why the greatest entrepreneurs of our time weren’t primarily driven by money but by an obsession with the offerings of their companies.

Goodhart’s law states that once a measure becomes a target, it ceases to be a good measure.

In a capitalist system, dollars are a measure of value. Yet so often when a business executive focuses on maximizing the dollar value that their business is worth they fail to do so. But when they seek to maximize the value their business provides, dollars often follow.

The sequence is ultimately what matters. That is what works in a capitalist system that a money-driven capitalist may fail to understand. Dollars follow the value provided and to forget that crucial sequence is to forget how capitalism works.

The best entrepreneurs are driven by more than money. Because if the desire to make money was what primarily motivated them, they would have quit their businesses as soon as their fortunes were made. But they persisted for decades after the points at which money was of no object to them. Because the mission superseded the money. That is why the greatest, and most valuable, businesses are built by mission-driven entrepreneurs.

“I think life is so much richer than just business and money. To me business is part self-expression.” - Sam Parr

Reply