- Poor Jack's Almanack

- Posts

- Focus!

Focus!

The Key to Success

A question was once posed to a private dinner party whose guests counted Warren Buffett and Bill Gates among their numbers.

The question was this - what is the secret to success?

Buffett and Gates replied with the same one word - Focus.

David Senra, the producer of Founders podcast, was asked to summarize his main takeaways after reading over 400 biographies of history’s greatest entrepreneurs.

He responded with a single word - Focus.

Charlie Munger once said, “I didn’t succeed in life because of intelligence. I succeeded because I had a long attention span.”

Charlie Munger and David Senra - evangelists of the focus philosophy.

Self-help/business gurus claim that the key to life is a “secret”. And that this “secret” is kept from you by those who know how to use it. And that once you know this “secret” your life will entirely change overnight.

But the truth is, there is no secret.

We all know the key to success intuitively - work hard at something you have some natural inclination towards for long periods of time and success will likely come your way.

That’s it. That’s the big secret.

But like so many things in life, while this truth is simple, it is not easy.

On his recent Invest Like the Best appearance, David Senra said in a relieved voice “I think the thing I’m most proud of in my life is I grinded for five and a half years with no visible progress and I didn’t give up.”

It’s hard to comprehend how a podcast with as devoted and large a cult following as Founders has today, took over five years to become popular.

After over 200 episodes, it finally reached the critical mass needed to become a mega hit in the business podcast world. And because Senra simply (again, not easily) plugged away at his work, his podcast is now lucrative and gave him the opportunity to meet titans of our time like Charlie Munger and Sam Zell.

After each early episode, Senra could have asked “What am I doing wrong? Why isn’t this gaining traction? Should I try something different? Pursue a different strategy?” And I’m sure these thoughts did cross his mind - afterall, he said during the interview that he’s not sure he could have stayed the course for over five years with little to no success if he started Founders over today.

But Senra remained focused on what he was doing, abiding by the Munger mantra “take a simple idea and take it seriously.”

The self-help industry is an interesting racket because it is more about making the customer feel smart or like they are making progress than it is about real progress. This makes sense - people like to feel smart and they like to feel like they are making progress. The self-help industry sells that feeling under the guise of selling real progress.

But real progress is often boring and dull - it isn’t sensational.

It’s coming in day after day and punching the clock.

It’s sitting down at the computer and pressing publish over and over again.

It’s investing a portion of your income into the S&P 500 every two weeks for decades.

The financial writer, Morgan Housel, has sold over 9 million books, is on the board of directors for Markel (a corporation with a $25B market cap), and is a partner at a multi-hundred-million-dollar AUM venture fund.

He’s probably the most successful financial writer of the 21st century.

Morgan Housel - arguably the most successful financial writer of the 21st century.

But when asked about his career on the Making Media podcast, Housel said “The thing that sticks out to me the most is that I feel like there’s never been a major breakthrough in my career. I felt like it was always just like 10% growth every year or whatever the figure was… it’s been a pretty slow progression. And I feel like if I compare myself today to 2007, when I started writing, it’s like ‘Oh my god, there’s been a lot of progress.’”

It’s a pretty remarkable statement from a man of his accomplishments.

Over a career selling millions of books, there was never a moment where he felt like there was a huge breakthrough, it was all just consistent, boring progress that seemed small in any given year but when looked back upon after decades is mindboggling.

The nature of compounding is funny because it is so unintuitive for people. Yet it’s probably the most powerful and important concept that exists.

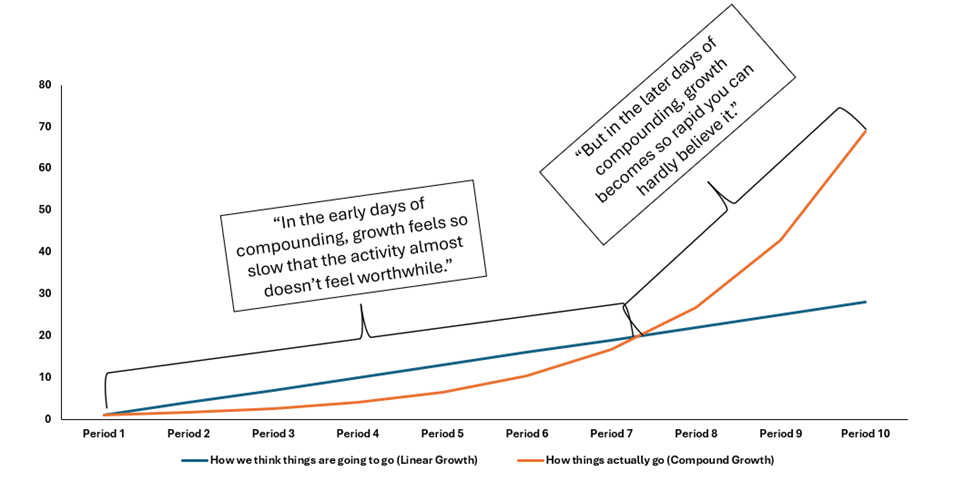

In the early days of compounding, growth feels so slow that the activity almost doesn’t feel worthwhile. But in the later days of compounding, the growth becomes so rapid that you can hardly believe it.

Linear vs. Compound Growth

The key is to endure during that period of seemingly stagnant growth.

But endurance isn’t solely a matter of willpower, it’s a matter of simplicity. When the name of the game is staying in it as long as possible, the key is to remove all factors that could eliminate you from the game, chief among these being the boredom induced distraction of complexity.

Will Manidis said “the entire history of professional investing is people learning that the secret is to simply own a lot of very few, very good, businesses over very long duration, getting bored, introducing complexity, and losing all their money before realizing the simple option was right”

This has happened so many times.

The Hunt brothers lost their fortune trying to corner the silver market.

Coca-Cola, despite having an already legendary product, traded it out for new coke.

Sam Bankman-Fried, despite having a successful market-making business, used customer funds to run a risky hedge fund that destroyed the hedge fund and the market-making business.

These people and companies were already successful - they had something that worked. But the allure of complexity distracted them. They lost their focus.

Manidis’ words are true of far more than investing - I think they’re true of life.

Life is about picking a select few endeavors and relationships to invest in and then doing so over an extremely long duration without introducing complexity that interrupts or corrupts the activity.

In all matters of a compounding nature, the best thing we can do for ourselves is prevent overthinking so that we can stay the course.

The best financial plan is the one you will stick with for decades, not the one with the best returns in any given year.

The best workout plan is the one you will stick with for decades, not the one that will burn the most calories on any given day.

The best diet is the one you will stick with for decades, not the one with the best nutritional attributes in any given meal.

David Senra recounted occasions when listeners reached out to him with suggestions for the podcast.

They recommended Senra have other people read the books so that he could produce more episodes and add efficiency to the process to grow the podcast further.

But Senra scoffs at these ideas.

They introduce complexity and disingenuousness to the process of making Founders that would ultimately destroy it. Senra has a process that works - it’s simple and effective.

All that’s left to do is keep doing it day after day, month after month, year after year.

No one would pay for the advice “just stay focused” but it’s often the best course of action.

Morgan Housel has another line that I love that says “Saying ‘I’m in it for the long run’ is a bit like standing at the base of Mount Everest, pointing to the top, and saying, ‘That’s where I’m heading.’ Well, that’s nice. Now comes the test.”

But I think a better analogy is this “Saying ‘I’m in it for the long run’ is a bit like saying you’re going to drive to the end of a long, plain road, while flashing lights and signs on the periphery try to convince you there’s a shortcut. Well, that’s nice. Now comes the test.”

Reply