- Poor Jack's Almanack

- Posts

- Two Types of Problems

Two Types of Problems

Why Some Problems Are Here to Stay and Others Are Temporary

There are two types of problems: those that can be solved by behavior and those that can be solved with information.

Personal finance is a problem that can be solved by behavior. The rules to become financially free are clear, simple, and known:

Spend less than you earn.

Invest a portion of your income consistently over time.

Avoid most kinds of debt except the kind related to your primary residence.

Those 27 words essentially sum up every tenet of the subject. You can read The Psychology of Money, Rich Dad Poor Dad, The Richest Man in Babylon, The Millionaire Next Door, and any other personal finance book that piques your interest but they will all, more or less, repeat the above 3 principles in a far more eloquent, palatable, and entertaining way.

Of course, there’s further minutiae to the topic of personal finance but each more detailed question still falls under one of the three core tenets. Learning how to effectively budget for your household falls under the “spend less than you earn” bucket. Deciding which investment vehicles to choose falls under the “invest a portion of your income consistently over time” bucket. Determining how much you should budget for the purchase of your first home falls under the “avoid most kinds of debt except the kind related to your primary residence” bucket. Every detailed question comes back to those 3 simple, not easy, tenets.

But the funny thing about personal finance is that despite the fact that it is a solved problem in terms of the information needed to succeed at it, the majority of Americans are still horrifically bad at it. According to a 2022 BankRate survey, 57% of Americans would need to borrow or sell something to cover a $1,000 emergency expense.

I recognize that for some people in that 57% statistic their failure to have adequate funds is not a matter of knowledge or behavior, it’s a matter of necessity. They may be working multiple jobs just to keep their family fed and under a safe roof, living paycheck to paycheck to simply meet the bare necessities. But for a large portion of that 57% the knowledge is out there, yet their behavior causes the problem to persist.

Behavioral problems are interesting because they are perpetual. They will never be solved.

Some individuals will improve their financial situations but people as a whole will always be bad at personal finance because it requires skills that aren’t inherent to our nature. To do really well at personal finance you need to develop patience, hard-work, perseverance, humility, a willingness to embrace risk, and an ability to insulate yourself from envy.

These traits haven’t come naturally to us for centuries as evidenced by the fable of Cain and Abel, the myth of Achilles, and the legend of Jay Gatsby. We have a predisposition towards the traits that make us terrible money managers and so naturally this problem will persist.

Problems that can be solved by information are different. They are hard to overcome, but once they are solved, they cease to be problems for mankind.

In 1900 around ⅓ of all deaths in America were related to infection related illnesses, many of which we would not blink an eye at today.

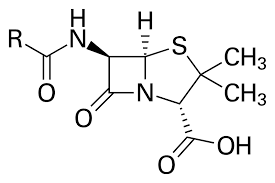

But this all changed with the introduction of penicillin - the first manmade antibiotic.

Once penicillin was discovered as a treatment, developed into a consumer product, and produced at scale, the mortality rate per 100,000 people with infectious diseases fell from 200 to around 50. The effects of this medicine were even more pronounced in the field of battle where germs spread as freely as fear among the soldiers. While infections related to wounds caused 18% of total deaths in World War II prior to the introduction of penicillin, that figure plummeted to below 1% of total deaths after soldiers gained access to the miracle treatment.

Penicillin - the miracle treatment.

Producing electric vehicles at scale is another problem that can be solved by information that we have yet to completely conquer.

Tesla spent $4.4B on research & development in 2024 trying to analyze, experiment, and theorize ways to improve their vehicles and manufacturing capabilities. And though they have spent gobs of money and hundreds of thousands of man hours, still only around 1.4% of cars in the US are electric. Despite this intimidating figure, we can feel confident that one day they will uncover the requisite knowledge necessary to boost that figure to 100.0%, achieving what was previously impossible.

That’s the thing about informational problems, they are extraordinarily difficult to overcome but once the knowledge required to solve the problem is attained, the problems cease to exist, permanently. Once penicillin was introduced, most infections ceased to be commonly life threatening. Once Elon Musk and Tesla figure out how to produce electric vehicles of equivalent quality to gas vehicles, profitably, at scale, that knowledge will forever end the problem of vehicular pollution in our atmosphere.

I have a hot take. I don’t think adding personal finance courses to high school curriculum will do much to solve the problem of poor financial health in America. Because personal finance isn’t a matter of knowledge, it’s a matter of behavior.

You can tell a high schooler that they shouldn’t finance the purchase of a brand new car but that knowledge isn’t going to prevent them from wanting to. You can tell a high schooler that they should set aside a portion of their income to save for retirement, but that knowledge won’t make the idea of retirement seem anymore tangible and worth saving for. You can tell a high schooler that they should use credit cards responsibly, but that knowledge won’t make the purchase of items on credit feel less free.

People are really bad at ignoring their natures, so you can count on the same behavioral problems we had in biblical times persisting well into the future. Yet people are equally good at accumulating knowledge so you can count on our largest informational problems fading well into the past.

Reply